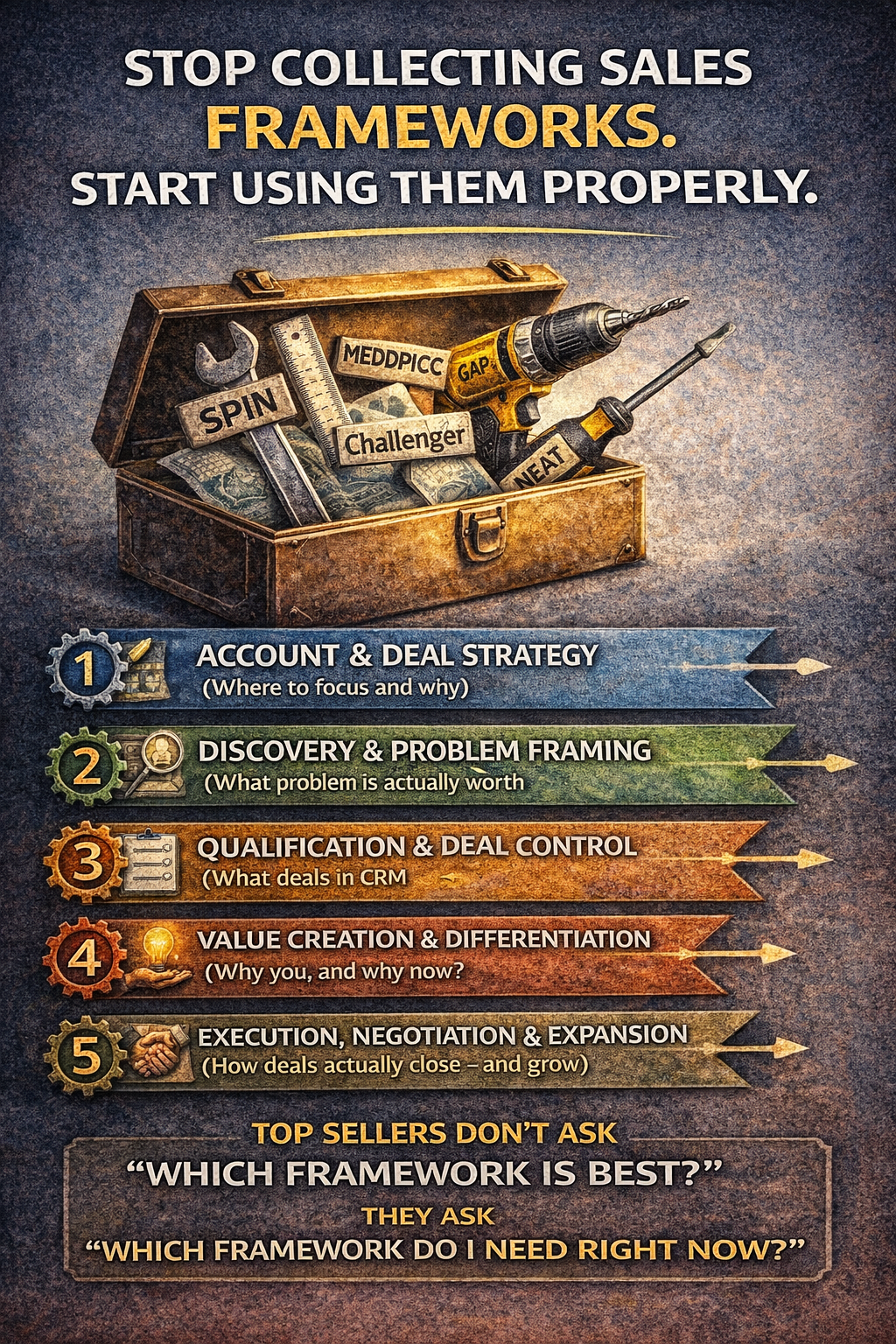

Stop Collecting Sales Frameworks. Start Using Them Properly.

Sales frameworks are everywhere.

SPIN. MEDDPICC. Challenger. GAP. NEAT. Target Account Selling.

Most sellers can name them.

Very few know when to use them.

Almost no one combines them correctly.

Top performers don’t treat frameworks like Pokémon cards. They don’t try to “catch them all.” They cluster them by purpose and apply them at the right moment in the deal lifecycle.

Below is a practical, real-world way to do exactly that—no theory, no buzzwords, just how complex B2B deals actually get done.

Cluster 1: Account and Deal Strategy

Where to focus and why

Frameworks

Target Account Selling

Political Mapping / Command of the Sale

Competitor Matrix

What this cluster solves

Who is worth selling to

Who really decides

Where you win—and where you lose

This cluster runs before and throughout the deal. Its main job is preventing wasted effort, bad-fit accounts, and single-threaded disasters.

How it works in practice

Identify high-value accounts based on ICP, revenue potential, and strategic fit

Map power, influence, blockers, and champions

Position against competitors on real differentiation, not feature checklists

Real B2B example

Enterprise industrial equipment deal (€1.5M)

Cluster 2: Discovery and Problem Framing

What problem is actually worth solving?

Frameworks

SPIN Selling

GAP Selling

Solution Selling (Diagnose Before Prescribe)

What this cluster solves

Customers who “like” you but never move

Feature dumping

Weak urgency

This cluster creates clarity, tension, and momentum.

How it works in practice

SPIN surfaces explicit and hidden pain

GAP Selling quantifies current state versus future state

Solution Selling prevents premature pitching

Real B2B example

Manufacturing analytics SaaS

Cluster 3: Qualification and Deal Control

Is this deal real—and winnable?

Frameworks

MEDDPICC

NEAT Selling

What this cluster solves

Fake deals in CRM

End-of-quarter surprises

“Procurement suddenly killed it”

This cluster is about truth, not optimism.

How it works in practice

MEDDPICC validates metrics, process, paper, and power

NEAT sharpens focus on need, economic impact, access, and timing

Real B2B example

IT infrastructure outsourcing deal

Cluster 4: Value Creation and Differentiation

Why you, and why now?

Frameworks

Challenger Sale

Value Proposition Design

Pain Chain Development

What this cluster solves

“You all look the same”

Price pressure

Decision paralysis

This cluster changes how the customer thinks.

How it works in practice

Challenger reframes the problem in uncomfortable but useful ways

Pain Chains connect user pain to management impact and executive risk

Value is framed in outcomes, not features

Real B2B example

Energy efficiency solutions for data centers

Cluster 5: Execution, Negotiation, and Expansion

How deals actually close—and grow

Frameworks

Command of the Sale

Negotiation Management

Land and Expand

What this cluster solves

Endless meetings

Scope creep

One-off wins with no growth

This cluster turns momentum into contracts and long-term accounts.

How it works in practice

Sellers lead the process instead of reacting to it

Negotiation focuses on value trade-offs, not discounts

The first deal is designed as a platform for expansion

Real B2B example

Global software rollout

The Biggest Mistake Sellers Make

They ask:

“Which framework is best?”

Top performers ask:

“Which framework do I need right now?”

Frameworks are not beliefs. They are tools.

And tools only work when used deliberately, together, and in context.

Final Thought

If you master:

Strategy

Discovery

Qualification

Value creation

Execution

You stop chasing deals.

You start orchestrating them.

Which framework do you rely on most today—and which one are you underusing?